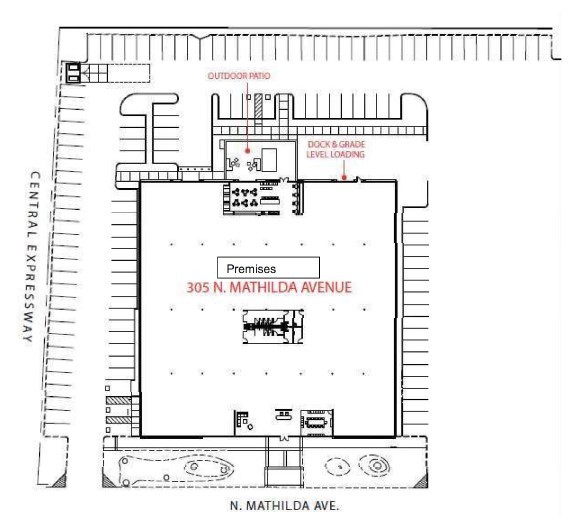

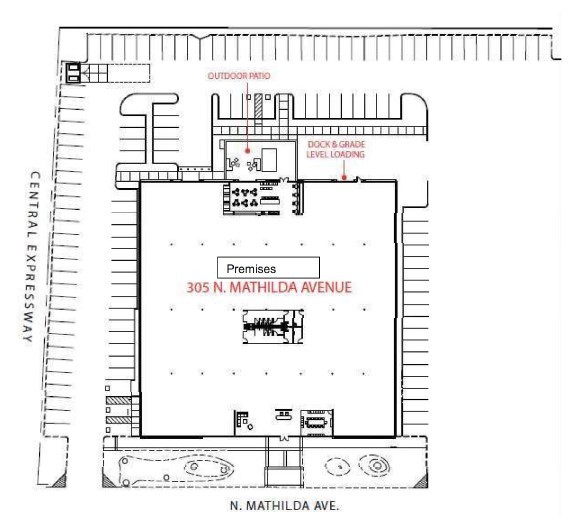

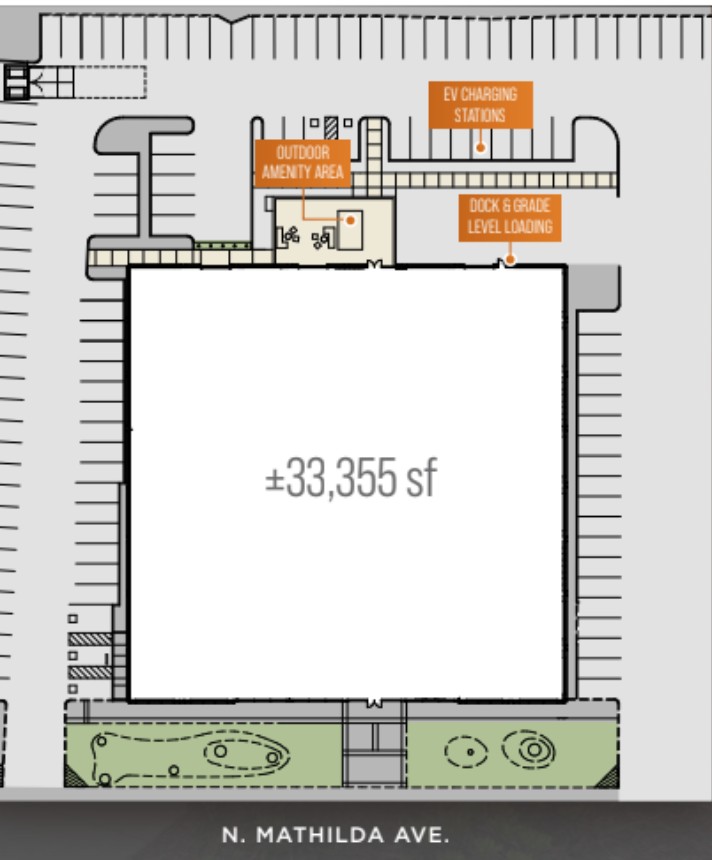

EXHIBIT A

DEPICTION OF THE BUILDING AND PREMISES

305 N. MATHILDA AVENUE

EXHIBIT A

-1-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

EXCHANGE ACT OF 1934

For the quarterly period ended

or

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

☒ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 9, 2025, there were

TABLE OF CONTENTS

2

Cautionary Note on Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Quarterly Report on Form 10-Q other than statements of historical fact, including statements regarding our future operating results and financial position, including profitability, our business strategy and plans, market growth, product and service releases, the status of product development, compliance with applicable listing requirements or standards of The Nasdaq Capital Market (“Nasdaq”), demand for our products and services, and our objectives for future operations, are forward-looking statements. In some cases the words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” or the negative of these terms and similar expressions are intended to identify forward-looking statements.

Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements about:

| ● | The success of our products, which will require significant capital resources and years of development efforts; |

| ● | Our deployments and market acceptance of our products; |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; |

| ● | Our limited operating history by which performance can be gauged; |

| ● | Our ability to continue as a going concern; |

| ● | Our ability to comply with all applicable listing requirements or standards of The Nasdaq Capital Market; |

| ● | Our ability to operate and collect digital information on behalf of our clients, which is dependent on the privacy laws of jurisdictions in which our Autonomous Security Robots (“ASR”) and Emergency Communication Devices (“ECD”) operate, as well as the corporate policies of our clients, which may limit our ability to fully deploy our technologies in various markets; |

| ● | Our ability to raise capital; and |

| ● | Our ability to manage our research, development, expansion, growth, and operating expenses. |

We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, and assumptions and other important factors that could cause actual results to differ materially from those stated, including:

| ● | We have not yet generated any profits or significant revenues, anticipate that we will incur continued losses for the foreseeable future, and may never achieve profitability. |

| ● | The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern, and we may not be able to continue to operate the business if we are not successful in securing additional funding. |

| ● | We expect to experience future losses as we execute on our business strategy and will need to generate significant revenues to achieve profitability, which may not occur. |

| ● | We may not be able to comply with all applicable listing requirements or standards of The Nasdaq Capital Market, and Nasdaq could delist our Class A Common Stock. |

3

| ● | We are subject to potential fluctuations in operating results due to our sales cycle. |

| ● | If we are unable to acquire new customers, our future revenues and operating results will be harmed. Likewise, potential customer turnover in the future, or costs we incur to retain our existing customers, could materially and adversely affect our financial performance. |

| ● | We are subject to the loss of contracts, due to terminations, non-renewals or competitive re-bids, which could adversely affect our results of operations and liquidity, including our ability to secure new contracts from other customers. |

| ● | Our future operating results are difficult to predict and may be affected by a number of factors, many of which are outside of our control. |

| ● | Our financial results will fluctuate in the future, which makes them difficult to predict. |

| ● | Shifts in global economic conditions-including, but not limited to, changes in inflation, interest rates, tariffs, and other trade restrictions-could reduce customer spending and impact the financial stability of our clients and business partners. These effects may, in turn, negatively influence our financial health, operational performance, and available cash resources. |

| ● | Adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults or non-performance by financial institutions, could adversely affect our business, financial condition or results of operations. |

| ● | We have a limited number of deployments, and limited market acceptance of our products could harm our business. |

| ● | We cannot assure you that we will effectively manage our growth. |

| ● | Our costs may grow more quickly than our revenues as we research and develop new products, harming our business and profitability. |

| ● | Any debt arrangements that we enter into may impose significant operating and financial restrictions on us, which may prevent us from capitalizing on business opportunities. A breach of any of the restrictive covenants under such debt arrangements may cause us to be in default under our debt arrangements, and our lenders could foreclose on our assets. |

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Quarterly Report on Form 10-Q may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. Our forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q, and we undertake no obligation to update any of these forward-looking statements for any reason after the date of this Quarterly Report on Form 10-Q or to conform these statements to actual results or revised expectations, except as required by applicable law.

In this Quarterly Report on Form 10-Q, the words “we,” “us,” “our,” the “Company” and “Knightscope” refer to Knightscope, Inc., unless the context requires otherwise.

4

PART I —FINANCIAL INFORMATION

Item 1. Financial Statements

KNIGHTSCOPE, INC.

Condensed Balance Sheets

(In thousands, except share and per share data)

March 31, |

| December 31, | |||||

|

| 2024 |

| ||||

(unaudited) | (1) | ||||||

ASSETS | |||||||

Current assets: |

|

|

|

|

| ||

Cash and cash equivalents | $ | | $ | | |||

Restricted cash |

| — |

| | |||

Accounts receivable, net of allowance for credit losses of $ |

| |

| | |||

Inventory | | | |||||

Prepaid expenses and other current assets |

| |

| | |||

Total current assets |

| |

| | |||

Autonomous Security Robots, net |

| |

| | |||

Property, equipment and software, net |

| |

| | |||

Operating lease right-of-use-assets |

| |

| | |||

Goodwill | | | |||||

Intangible assets, net | | | |||||

Other assets |

| |

| | |||

Total assets | $ | | $ | | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| |||

Current liabilities: |

|

|

|

| |||

Accounts payable | $ | | $ | | |||

Accrued expenses and other current liabilities |

| |

| | |||

Deferred revenue |

| |

| | |||

Operating lease liabilities, current |

| |

| | |||

Debt obligations, current | | | |||||

Total current liabilities |

| |

| | |||

Non-current liabilities: |

|

|

|

| |||

Debt obligations, net of debt issuance costs of $ |

| |

| | |||

Other noncurrent liabilities | | | |||||

Total liabilities |

| |

| | |||

Commitments and contingencies (Note 7) |

|

|

|

| |||

Stockholders’ equity: |

|

|

|

| |||

Preferred Stock, $ | — | — | |||||

Class A Common Stock, $ |

| |

| | |||

Class B Common Stock, $ |

| — |

| — | |||

Additional paid-in capital |

| |

| | |||

Accumulated deficit |

| ( |

| ( | |||

Total stockholders’ equity |

| |

| | |||

Total liabilities and stockholders’ equity | $ | | $ | | |||

| (1) | The condensed balance sheet as of December 31, 2024 was derived from the audited balance sheet as of that date. |

The accompanying notes are an integral part of these condensed financial statements.

5

KNIGHTSCOPE, INC.

Condensed Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

Three Months Ended March 31, | |||||||

| 2025 |

| 2024 |

| |||

Revenue, net | |||||||

Service | $ | | $ | | |||

Product | | | |||||

Total revenue, net | | | |||||

Cost of revenue, net |

| ||||||

Service | | | |||||

Product | | | |||||

Total cost of revenue, net | | | |||||

Gross loss | ( | ( | |||||

Operating expenses: |

|

|

|

| |||

Research and development |

| |

| | |||

Sales and marketing |

| |

| | |||

General and administrative |

| |

| | |||

Restructuring charges | — | | |||||

Total operating expenses |

| |

| | |||

Loss from operations |

| ( |

| ( | |||

Other income (expense): |

|

|

|

| |||

Change in fair value of warrant and derivative liabilities |

| — |

| | |||

Interest income (expense), net | ( | ( | |||||

Other income (expense), net |

| |

| ( | |||

Total other income (expense) |

| ( |

| | |||

Net loss before income tax expense |

| ( |

| ( | |||

Income tax expense |

| — |

| — | |||

Net loss | $ | ( | $ | ( | |||

Basic and diluted net loss per common share | $ | ( | $ | ( | |||

Weighted average shares used to compute basic and diluted net loss per share (1) | | | |||||

| (1) | Share amounts for the period ended March 31, 2024 have been adjusted to reflect the impact of a -for-50 reverse stock split of the Company’s common stock effected in September 2024 as discussed in Note 1. |

The accompanying notes are an integral part of these condensed financial statements.

6

KNIGHTSCOPE, INC.

Condensed Statements of Preferred Stock and Stockholders’ Equity (Deficit)

(In thousands, except share and per share data)

(Unaudited)

Series m | Series m-2 | Series S | Series A | Series B | Class A | Class B | ||||||||||||||||||||||||||||||||||||||

Preferred | Preferred | Preferred | Preferred | Preferred | Common | Common | Additional | Total | ||||||||||||||||||||||||||||||||||||

Stock | Stock | Stock | Stock | Stock | Stock | Stock | Paid-in | Accumulative | Stockholders’ | |||||||||||||||||||||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| capital |

| Deficit |

| Equity (Deficit) | |||||||||||

Balance as of December 31, 2023 | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | — | $ | | $ | ( | $ | ( | |||||||||||||||||

Stock-based compensation | — | — | — | — | — | — | — | — | — | — | — | — | — | — | | — | | |||||||||||||||||||||||||||

Proceeds from Equity Sale, net of issuance costs | — | — | — | — | — | — | — | — | — | — | | — | — | — | | — | | |||||||||||||||||||||||||||

Share conversion to common stock | ( | ( | — | — | ( | ( | — | — | — | — | | — | — | — | | — | | |||||||||||||||||||||||||||

Share conversion costs | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||

Net loss | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||

Balance as of March 31, 2024 | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | — | $ | | $ | ( | $ | ( | |||||||||||||||||

Note: Share amounts have been adjusted to reflect the impact of a -for-50 reverse stock split of the Company’s common stock effected in September 2024 as discussed in Note 1.

Series m | Series m-2 | Series S | Series A | Series B | Class A | Class B |

| |||||||||||||||||||||||||||||||||||||

Preferred | Preferred | Preferred | Preferred | Preferred | Common | Common |

| Additional | Total | |||||||||||||||||||||||||||||||||||

Stock | Stock | Stock | Stock | Stock | Stock | Stock |

| Paid-in |

| Accumulative | Stockholders’ | |||||||||||||||||||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| capital |

| Deficit |

| Equity | |||||||||||

Balance as of December 31, 2024 | — | $ | — | — | $ | — | — | $ | — | — | $ | — | — | $ | — | | $ | | | $ | — | $ | | $ | ( |

| $ | | ||||||||||||||||

Stock-based compensation | — | — | — | — | — | — | — | — | — | — | — | — | — | — | | — | | |||||||||||||||||||||||||||

Proceeds from Equity Sale, net of issuance costs | — | — | — | — | — | — | — | — | — | — | | | — | — | | — | | |||||||||||||||||||||||||||

Proceeds from Direct Registration Offering | — | — | — | — | — | — | — | — | — | — | | | — | — | | — | | |||||||||||||||||||||||||||

Issuance of vendor warrants for consulting services | — | — | — | — | — | — | — | — | — | — | — | — | — | — | | — | | |||||||||||||||||||||||||||

Prefunded warrants exercised | — | — | — | — | — | — | — | — | — | — | | | — | — | ( | — | — | |||||||||||||||||||||||||||

Net loss | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||

Balance as of March 31, 2025 | — | $ | — | — | $ | — | — | $ | — | — | $ | — | — | $ | — | | $ | | | $ | — | $ | | $ | ( | $ | | |||||||||||||||||

The accompanying notes are an integral part of these condensed financial statements.

7

KNIGHTSCOPE, INC.

Condensed Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended March 31, | ||||||

| 2025 |

| 2024 | |||

Cash Flows From Operating Activities | ||||||

Net loss |

| $ | ( |

| $ | ( |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| ||

Depreciation and amortization |

| |

| | ||

Loss on disposal of Autonomous Security Robots |

| — |

| | ||

Loss on disposal of property and equipment |

| — |

| | ||

Stock compensation expense |

| |

| | ||

Warrants issued in exchange for consulting services | | — | ||||

Change in fair value of warrant and derivative liabilities |

| — |

| ( | ||

Accrued interest | | | ||||

Amortization of debt discount |

| |

| | ||

Changes in operating assets and liabilities: |

|

| ||||

Accounts receivable, net |

| ( |

| ( | ||

Inventory | | ( | ||||

Prepaid expenses and other assets |

| |

| | ||

Accounts payable |

| ( |

| ( | ||

Accrued expenses and other current liabilities |

| |

| ( | ||

Deferred revenue |

| ( |

| ( | ||

Other current and noncurrent liabilities |

| ( |

| ( | ||

Net cash used in operating activities |

| ( |

| ( | ||

Cash Flows From Investing Activities |

|

|

|

| ||

Purchases and related costs incurred for Autonomous Security Robots |

| ( |

| ( | ||

Net cash used in investing activities |

| ( |

| ( | ||

Cash Flows From Financing Activities |

|

|

|

| ||

Proceeds from equity sale, net of issuance costs |

| |

| | ||

Proceeds from issuance of Public Safety Infrastructure Bonds, net of issuance costs |

| — |

| | ||

Proceeds from issuance of common stock and pre-funded warrants sold for cash, net of issuance costs |

| |

| — | ||

Repayments of debt obligations | ( | — | ||||

Share conversion costs | — | ( | ||||

Net cash provided by financing activities |

| |

| | ||

Net change in cash, cash equivalents and restricted cash |

| |

| | ||

Cash, cash equivalents and restricted cash at beginning of the period |

| |

| | ||

Cash, cash equivalents and restricted cash at end of the period | $ | | $ | | ||

Financing of insurance premiums | $ | | $ | — | ||

Conversion of preferred stock to common stock | $ | — | $ | | ||

The accompanying notes are an integral part of these condensed financial statements.

8

KNIGHTSCOPE, INC.

Notes to Condensed Financial Statements

(Dollars in thousands, unless otherwise stated)

(Unaudited)

NOTE 1: The Company and Summary of Significant Accounting Policies

Description of Business

Knightscope, Inc. (the “Company”), a Delaware corporation, is a public safety innovator that builds Autonomous Security Robots (“ASR”) and Emergency Communication Devices (“ECD”). The Company designs, manufactures, and deploys its technologies to improve public safety and to protect the places people live, work, study and visit. The Company provides its cutting-edge solutions, including remote monitoring capabilities, to both the private sector and to government clients including law enforcement.

The Company operates in a highly fragmented U.S. public safety market that is experiencing strong demand for automation and artificial intelligence-driven solutions due to rising labor costs, staffing shortages, inconsistent service quality, and challenging crime rates. The Company’s solutions combine proactive physical deterrence with critical emergency response tools and remote monitoring, offering an integrated approach to public safety.

The Company was founded in April 2013 and is headquartered in Mountain View, California, the heart of Silicon Valley.

Basis of Presentation and Liquidity

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s fiscal year end is December 31.

The unaudited condensed financial statements have been prepared in accordance U.S. GAAP, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and note disclosures have been condensed or omitted pursuant to such rules and regulations. The unaudited condensed financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for a fair presentation of the period presented. Unaudited interim results are not necessarily indicative of the results for the full fiscal year or for any future interim periods. These condensed financial statements should be read in conjunction with the Company’s audited financial statements and accompanying notes for the year ended December 31, 2024 included in the Company’s Annual Report on Form 10-K for the year ended

In accordance with Accounting Standards Codification (“ASC”) Topic 205-40, Presentation of Financial Statements - Going Concern, the Company evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year after the date that these condensed financial statements are issued.

The condensed financial statements of the Company have been prepared on a going concern basis, which contemplates the realization of assets and the discharge of liabilities in the normal course of business. Cash and cash equivalents on hand were $

9

concern. These factors raise substantial

Reverse Stock Split

Segments

The Company has

Reclassifications

Certain reclassifications have been made to the fiscal year 2024 condensed financial statements to conform to the fiscal year 2025 presentation. The reclassifications had no impact on total assets, total liabilities, or stockholders’ equity.

Comprehensive Loss

Net loss was equal to comprehensive loss for the three month periods ended March 31, 2025 and 2024.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make judgements, estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses. Specific accounts that require management estimates include, but are not limited to, estimating the useful lives of the Company’s ASRs, property and equipment and intangible assets, certain estimates required within revenue recognition, warranty and allowance for credit losses, determination of deferred tax valuation allowances, estimating fair values of the Company’s share-based awards, warrant liability, and derivative liabilities, inclusive of any contingent assets and liabilities. Actual results could differ from those estimates and such differences may be material to the condensed financial statements.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company places its cash and cash equivalents in highly liquid instruments with, and in the custody of, financial institutions with high credit ratings.

Restricted Cash

The Company had restricted cash as collateral for the Company’s corporate credit card program which was discontinued during the first quarter of 2025. As of March 31, 2025 and December 31, 2024, the carrying value of restricted cash was $

10

Concentrations of Credit Risk

The Company extends credit to clients in the normal course of business and performs ongoing credit evaluations of its clients. Concentrations of credit risk with respect to accounts receivable exist to the full extent of amounts presented in the financial statements. The Company does not require collateral from its clients to secure accounts receivable.

Accounts receivable was derived from the leasing of proprietary ASRs along with access to browser-based interface Knightscope Security Operations Center (“KSOC”) as well as the sale of ECDs. The Company reviews its receivables for collectibility based on historical loss patterns, aging of the receivables, and assessments of specific identifiable client accounts considered at risk or uncollectible and provides allowances for potential credit losses, as needed. The Company also considers any changes to the financial condition of its clients and any other external market factors that could impact the collectibility of the receivables in the determination of the allowance for credit losses. Based on these assessments, the Company recorded a $

As of March 31, 2025, the Company had one client whose accounts receivable balance totaled 10% or more of the Company’s total accounts receivable (

For the three months ended March 31, 2025, the Company had one client who individually accounted for 10% or more of the Company’s total revenue, net (

Inventory

Inventory, principally purchased components, is stated at the lower of cost or net realizable value. Cost is determined using an average cost, which approximates actual cost on a first-in, first-out basis. Inventory in excess of salable amounts and inventory which is considered obsolete based upon changes in existing technology is written off. At the point of loss recognition, a new lower cost basis for that inventory is established and subsequent changes in facts and circumstances do not result in the restoration or increase in the new cost basis.

March 31, | December 31, | |||||

| 2025 |

| 2024 | |||

Raw materials | $ | | $ | | ||

Work in process |

| |

| | ||

Finished goods |

| |

| | ||

$ | | $ | | |||

11

Autonomous Security Robots, net

ASRs consist of materials, ASRs in progress and finished ASRs. ASRs in progress and finished ASRs include materials, labor and other direct and indirect costs used in their production. Finished ASRs are valued using a discrete bill of materials, which includes an allocation of labor and direct overhead based on assembly hours. Depreciation expense on ASRs is recorded using the straight-line method over their estimated expected lives, which currently ranges from

ASRs, net, consisted of the following:

March 31, | December 31, | |||||

| 2025 |

| 2024 | |||

Raw materials | $ | | $ | | ||

ASRs in progress |

| |

| | ||

Finished ASRs |

| |

| | ||

| |

| | |||

Less: accumulated depreciation on Finished ASRs |

| ( |

| ( | ||

ASRs, net | $ | | $ | | ||

The components of the Finished ASRs, net are as follows:

March 31, | December 31, | |||||

| 2025 |

| 2024 | |||

ASRs on lease or available for lease | $ | | $ | | ||

Demonstration ASRs |

| | | |||

Research and development ASRs |

| | | |||

Charge boxes | | | ||||

| | | ||||

Less: accumulated depreciation |

| ( | ( | |||

Finished ASRs, net | $ | | $ | | ||

Intangible Assets

The gross carrying amounts and accumulated amortization of the intangible assets with determinable lives are as follows:

March 31, 2025 | |||||||||||

Amortization | Gross | ||||||||||

Period | carrying | Accumulated | Carrying | ||||||||

Intangible assets with determinable lives |

| (years) |

| amount |

| amortization |

| amount, net | |||

Developed technology |

| $ | | $ | ( | $ | | ||||

Customer relationships |

|

| |

| ( |

| | ||||

Total | $ | | $ | ( | $ | | |||||

|

| December 31, 2024 | |||||||||

Amortization | Gross | ||||||||||

Period | carrying | Accumulated | Carrying | ||||||||

Intangible assets with determinable lives | (years) |

| amount |

| amortization |

| amount, net | ||||

Developed technology |

| $ | | $ | ( |

| $ | | |||

Customer relationships |

|

| |

| ( |

|

| | |||

Total | $ | | $ | ( |

| $ | | ||||

Intangible assets amortization expense totaled $

12

recorded in sales and marketing and cost of revenue, net - service in the amounts of $

As of March 31, 2025, future intangible assets amortization expense for each of the next five years and thereafter is as follows:

Year ending December 31, |

| Amount | |

2025 (remaining 9 months) | $ | | |

2026 |

| | |

2027 |

| | |

2028 |

| | |

2029 |

| | |

2030 and thereafter | | ||

Total | $ | | |

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

| March 31, |

| December 31, | |||

2025 | 2024 | |||||

Legal, consulting and financial services | $ | | $ | | ||

Sales tax | | | ||||

Warranty liability | |

| | |||

Payroll and payroll taxes | | | ||||

Customer deposits |

| |

| | ||

Credit cards |

| | | |||

Accrued interest | | — | ||||

Other |

| |

| | ||

$ | | $ | | |||

Warranty Liability

The liability for estimated warranty claims is accrued at the time of sale and the expense is recorded in the condensed statements of operations in cost of revenue, net - product. The liability is established using historical warranty claim experience. The current provision may be adjusted to take into account unusual or non-recurring events in the past or anticipated changes in future warranty claims. Adjustments to the warranty accrual are recorded if actual claim experience indicates that adjustments are necessary. Warranty reserves are reviewed to ensure critical assumptions are updated for known events that may impact the potential warranty liability.

Change in the warranty liability for the three months ended consisted of the following:

| March 31, | |||||

2025 |

| 2024 | ||||

Balance January 1, | $ | | $ | | ||

Provision for warranties issued |

| |

| | ||

Warranty services provided |

| ( |

| ( | ||

$ | | $ | | |||

Convertible Preferred Warrant Liabilities and Common Stock Warrants

Freestanding warrants to purchase shares of the Company’s preferred stock were classified as liabilities on the balance sheets at their estimated fair value because the underlying shares of preferred stock were contingently redeemable and, therefore, may have obligated the Company to transfer assets at some point in the future. The preferred stock warrants were recorded at fair value upon issuance and were subject to remeasurement to their respective estimated fair values. At

13

the end of each reporting period, changes in the estimated fair value of the preferred stock warrants were recorded in the condensed statements of operations. The Company adjusted the liability associated with the preferred stock warrants for changes in the estimated fair value until the earlier of the exercise or conversion. On May 15, 2024, the preferred stock warrants converted into warrants to purchase common stock and any liabilities recorded for the preferred stock warrants were reclassified to additional paid-in capital and are no longer subject to remeasurement. Common stock warrants that are not considered derivative liabilities are accounted for at fair value at the date of issuance in additional paid-in capital.

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with ASC 718, Compensation - Stock Compensation, which requires that the estimated fair value on the date of grant be determined using the Black-Scholes option pricing model with the fair value recognized over the requisite service period of the awards, which is generally the option vesting period. The Company’s determination of the fair value of the stock-based awards on the date of grant, using the Black-Scholes option pricing model, is affected by the fair value of the Company’s common stock as well as other assumptions regarding a number of highly complex and subjective variables. These variables include but are not limited to the Company’s expected stock price volatility over the term of the awards, and actual and projected employee option exercise behaviors. Because there is insufficient historical information available to estimate the expected term of the stock-based awards, the Company adopted the simplified method of estimating the expected term of options granted by taking the average of the vesting term and the contractual term of the option. The Company recognizes forfeitures as they occur when calculating stock-based compensation for its equity awards.

Basic and Diluted Net Loss per Share

Net loss per share of common stock is computed using the two-class method required for participating securities based on their participation rights. All series of convertible preferred stock are participating securities as the holders are entitled to participate in common stock dividends with common stock on an as converted basis. The voting, dividend, liquidation and other rights and powers of the common stock are subject to and qualified by the rights, powers and preferences of any series of preferred stock as may be designated by the Company’s Board of Directors and outstanding from time to time. In accordance with the two-class method, earnings allocated to these participating securities, which include participation rights in undistributed earnings with common stock, are subtracted from net loss to determine net loss attributable to common stockholders upon their occurrence.

Basic net loss per share is computed by dividing net loss attributable to common stockholders (net adjusted for preferred stock dividends declared or accumulated) by the weighted average number of common shares outstanding during the period. All participating securities are excluded from basic weighted average shares outstanding. In computing diluted net loss attributable to common stockholders, undistributed earnings are re-allocated to reflect the potential impact of dilutive securities. Diluted net loss per share attributable to common stockholders is computed by dividing net loss attributable to common stockholders by diluted weighted average shares outstanding, including potentially dilutive securities, unless anti-dilutive. Potentially dilutive securities that were excluded from the computation of diluted net loss per share for the three months ended March 31, 2025 and 2024 consist of the following:

| March 31, | March 31, | ||

2025 |

| 2024 | ||

Series A Preferred Stock (convertible to Class B Common Stock) |

| — |

| |

Series B Preferred Stock (convertible to Class B Common Stock) |

| — |

| |

Series m Preferred Stock (convertible to Class A Common Stock) |

| — |

| |

Series m-2 Preferred Stock (convertible to Class B Common Stock) |

| — |

| |

Series S Preferred Stock (convertible to Class A Common Stock) |

| — |

| |

Warrants to purchase common stock (convertible to Class A Common Stock) | | | ||

Warrants to purchase Series m-3 Preferred Stock (convertible to Class A Common Stock) |

| — |

| |

Warrants to purchase Series S Preferred Stock (convertible to Class A Common Stock) |

| — |

| |

Stock options |

| |

| |

Total potentially dilutive shares |

| |

| |

14

The weighted average number of shares of common stock outstanding as of March 31, 2025 includes the weighted average effect of the

As all potentially dilutive securities are anti-dilutive as of March 31, 2025 and 2024, diluted net loss per common share is the same as basic net loss per common share for each period.

On May 15, 2024 (the “Preferred Stock Conversion Date”), pursuant to the terms of the Company’s Amended and Restated Certificate of Incorporation, as amended to date (the “Certificate of Incorporation”) each share of the Company’s Super Voting Preferred Stock (as defined in the Certificate of Incorporation) was automatically converted into fully-paid, non-assessable shares of Class B Common Stock and each share of the Company’s Ordinary Preferred Stock (together with the Super Voting Preferred Stock, the “Preferred Stock”) was automatically converted into fully-paid, non-assessable shares of Class A Common Stock, in each case at the then effective applicable Conversion Rate, (as defined in the Certificate of Incorporation), as a result of the receipt by the Company of a written request for such conversion from the holders of a majority of the voting power of the Preferred Stock then outstanding. As a result, no shares of previously authorized Preferred Stock remain outstanding.

Accounting Pronouncements Adopted in 2025

None.

Accounting Pronouncements Not Yet Adopted

On December 14, 2023, the Financial Standards Accounting Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which establishes new income tax disclosure requirements in addition to modifying and eliminating certain existing requirements. Under the new guidance, entities must consistently categorize and provide greater disaggregation of information in the rate reconciliation. The amendment is effective for fiscal years beginning after December 15, 2024. The Company is currently

In November 2024, the FASB issued ASU No. 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses. The standard requires entities to disclose specified information about certain expenses in the notes to the financial statements, including employee compensation. It is effective on a prospective basis for annual periods beginning after December 15, 2026 and interim periods within fiscal years beginning after December 15, 2027 with early adoption permitted. Management does not believe the implementation of this standard will have a material impact on the Company’s financial statements.

Management has reviewed other recently issued accounting pronouncements issued or proposed by the FASB and does not believe any of these accounting pronouncements has had or will have a material impact on the condensed financial statements.

15

NOTE 2: Revenue and Deferred Revenue

Revenue Recognition

ASR related revenues

The Company derives its revenues from lease of proprietary ASRs along with access to the browser-based interface KSOC through contracts under the lease accounting that typically have a twelve (

ECD related revenues

The Company also derives revenues from sales of its ECDs and related services, such as installation, maintenance, and upgrades. Revenue is recognized when clients sign a full or partial certificate of completion, at which point, the Company can generate an invoice for its products and services. Clients also have the option to sign up for ongoing preventative and maintenance agreements. The maintenance revenue is recognized in the period the service is performed and the Company has determined that the term of the contracts has been fulfilled. Installation or upgrades revenue are recognized upon completion of the project/contracts. In certain cases, deferred revenue is recognized to account for unfinished contracts.

The Company determines revenue recognition through the following steps:

| ● | identification of the contract, or contracts, with a client; |

| ● | identification of the performance obligations in the contract |

| ● | determination of the transaction price; |

| ● | allocation of the transaction price to the performance obligations in the contract; and |

| ● | recognition of revenue when, or as, the Company satisfies a performance obligation. |

ASR subscription revenue

The Company recognizes ASR subscription revenue as follows:

ASR subscription revenue is generated from the lease of proprietary ASRs along with access to the browser-based interface KSOC through contracts that typically have

Deferred revenue

In connection with the Company’s Machine-as-a-Service (“MaaS”) subscription for the Company’s ASRs, the Company’s standard billing terms are annual in advance. In these situations, the Company records the invoices as deferred revenue and amortizes the subscription amount when the services are delivered, which generally is a

The Company derives its revenue from the lease subscription of its proprietary ASRs along with access to its browser and mobile based software interface, KSOC. MaaS subscription agreements typically have a

16

The Company also records deferred revenue from unfinished contracts for certain ECD related services.

Deferred revenue includes billings in excess of revenue recognized. Revenue recognized at a point in time generally does not result in significant increases in deferred revenue. Revenue recognized over a period generally results in a majority of the increases in deferred revenue as the performance obligations are fulfilled after the billing event. Deferred revenue was as follows:

| March 31, 2025 |

| December 31, 2024 | |||

Deferred revenue - short term | $ | | $ | | ||

Revenue recognized in the three months ended related to amounts included in deferred revenue at the beginning of the period | $ | | $ | | ||

Deferred revenue represents amounts invoiced to customers for contracts for which revenue has yet to be recognized based for subscription services to be delivered to the Company’s clients. Typically, the timing of invoicing is based on the terms of the contract.

Customer Deposits

Customer deposits primarily relate to sales of ECDs to certain customers dependent upon credit worthiness. The customer deposits are recorded as current liabilities and reclassed as a contra accounts receivable account at the time that the final invoice for the sale is generated following the completion of the revenue recognition criteria.

Disaggregation of revenue

The Company disaggregates revenue from contracts with customers into the timing of the transfers of goods and services by product line.

The following table summarizes revenue by product line and timing of recognition:

Three Months Ended March 31, | ||||||||||||||||||

2025 | 2024 | |||||||||||||||||

| Point in time |

| Over time |

| Total |

| Point in time |

| Over time |

| Total | |||||||

ASRs | $ | | $ | | $ | | $ | | $ | | $ | | ||||||

ECDs | | |

| | | |

| | ||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | ||||||

Product Revenue, net

Product revenue, net includes point of sale transactions related to the ECDs, including product, shipping, and installation.

Other revenue, net

Other non-ASR service-related revenues such as deployment services, decals and training revenue are recognized when services are delivered. Revenue from these transactions has been immaterial for all periods presented and is included in service revenue, net.

NOTE 3: Fair Value Measurement

The Company determines the fair market values of its financial instruments based on the fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The following are three levels of inputs that may be used to measure fair value:

17

| ● | Level 1 – Quoted prices in active markets for identical assets or liabilities. The Company considers a market to be active when transactions for the asset occur with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| ● | Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| ● | Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. The valuation of Level 3 investments requires the use of significant management judgments or estimation. |

In certain cases where there is limited activity or less transparency around inputs to valuation, securities are classified as Level 3. Level 3 liabilities that are measured at fair value on a recurring basis consist of the convertible preferred stock warrant liabilities.

The following tables summarize, for each category of assets or liabilities carried at fair value, the respective fair value as of March 31, 2025 and December 31, 2024, and the classification by level of input within the fair value hierarchy:

| Total |

| Level 1 |

| Level 2 |

| Level 3 | |||||

March 31, 2025 |

|

|

|

|

|

|

|

| ||||

Assets |

|

|

|

|

|

|

|

| ||||

Cash equivalents: |

|

|

|

|

|

|

|

| ||||

Money market funds | $ | | $ | | $ | — | $ | — | ||||

| Total |

| Level 1 |

| Level 2 |

| Level 3 | |||||

December 31, 2024 |

|

|

|

|

|

|

|

| ||||

Assets |

|

|

|

|

|

|

|

| ||||

Cash equivalents and restricted cash: |

|

|

|

|

|

|

|

| ||||

Money market funds | $ | | $ | | $ | — | $ | — | ||||

During the three month periods ended March 31, 2025 and 2024, there were

As of March 31, 2025 and December 31, 2024, there were

The following table sets forth a summary of the changes in the fair value of Company’s Level 3 warrant and derivative liabilities during the three month periods ended March 31, 2025 and 2024, which were measured at fair value on a recurring basis:

March 31, | March 31, | |||||

2025 | 2024 | |||||

Beginning Balance |

| $ | — |

| $ | |

Revaluation of Series m-3 and S Preferred Stock warrants | — | ( | ||||

Ending Balance | $ | — | $ | | ||

18

NOTE 4: Debt Obligations

Public Safety Infrastructure Bonds

On September 29, 2023, the Company filed an Offering Circular on Form 1-A/A (File No. 024-12314) (the “Offering Circular”) for the issuance of up to $

August 2024 Note

On October 10, 2022, the Company entered into a Securities Purchase Agreement (the “2022 Purchase Agreement”) with Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B (the “Holder”), pursuant to which the Company issued and sold to the Holder in a private placement (i) senior secured convertible notes (the “2022 Notes”), and (ii) warrants (the “2022 Warrants”) to purchase up to

On

Additionally, pursuant to the Waiver, the Holder agreed that the Company’s obligations under the 2022 Notes, the 2022 Purchase Agreement, the 2022 Registration Rights Agreement, the 2022 Warrants, and the other Transaction Documents (as defined in the 2022 Purchase Agreement) have been satisfied in full and such documents are terminated, except that the Company shall continue to comply with and perform Section 4.10 of the 2022 Purchase Agreement and Section 6 of the 2022 Registration Rights Agreement, in each case which provide for indemnification, and which in each case survive and shall remain in full force and effect.

The Waiver and August 2024 Note contain various representations and warranties, affirmative and negative covenants, financial covenants, events of default and other provisions and obligations.

19

In connection with the entry into the Waiver and the August 2024 Note, on the Issuance Date, the Company and the Holder entered into a security agreement, pursuant to which the Company granted to the Holder a security interest in substantially all current and future properties, assets, and rights of the Company.

As of March 31, 2025 and December 31, 2024, the outstanding balance of the August 2024 Note is $

Insurance Notes

On

The amortized carrying amount of the Company’s debt obligations consists of the following:

| March 31, | December 31, | ||||

| 2025 |

| 2024 | |||

Bonds, net of unamortized issuance costs of $ | $ | | $ | | ||

August 2024 Note | | | ||||

Insurance Notes | | — | ||||

Total debt |

| |

| | ||

Less: current portion of debt obligations |

| ( |

| ( | ||

Non-current portion of debt obligations | $ | | $ | | ||

NOTE 5: Capital Stock and Warrants

On the Preferred Stock Conversion Date of May 15, 2024, pursuant to the terms of the Company’s Certificate of Incorporation, each share of the Company’s Super Voting Preferred Stock (as defined in the Certificate of Incorporation) was automatically converted into fully-paid, non-assessable shares of Class B Common Stock and each share of the Company’s Ordinary Preferred Stock (as defined in the Certificate of Incorporation) was automatically converted into fully-paid, non-assessable shares of Class A Common Stock, in each case at the then effective applicable Conversion Rate (as defined in the Certificate of Incorporation), as a result of the receipt by the Company of a written request for such conversion from the holders of a majority of the voting power of the Preferred Stock then outstanding. As a result, there were

For periods subsequent to May 15, 2024, the preferred warrants were no longer subject to contractual modification provisions and were reclassified from a liability classification to an equity classification on the condensed balance sheet.

On August 16, 2024, the Company held an annual meeting of stockholders at which the Company’s stockholders approved, among other items, amendments to the Certificate of Incorporation, to authorize

Pre-funded Warrants and Underwriter Warrants

On November 21, 2024, the Company priced a public offering of Class A Common Stock and pre-funded warrants, generating gross proceeds of approximately $

20

warrant, respectively; each warrant was immediately exercisable at $

The transaction was completed pursuant to an underwriting agreement with Titan Partners Group LLC (“Titan”), a division of American Capital Partners, LLC, as sole book-runner; under that agreement the Company also issued Titan a

All pre-funded warrants issued in this offering were exercised in full as of March 31, 2025.

Vendor Warrants

On January 6, 2025, we issued unregistered warrants to The Washington Office, LLC, a consultant hired for advisory services, strategic communications, national security consulting, and government engagement support related to the Company’s products and services. The warrants are exercisable for such number of shares of our Class A Common Stock which equals $

A summary of the Company’s outstanding warrants as of March 31, 2025 is as follows:

Class of shares |

| Number of Warrants |

| Exercise Price |

| Expiration Date | |

Class A Common Stock (previously Series m-3 Preferred Stock) |

| | $ | | December 31, 2027 | ||

Class A Common Stock (previously Series S Preferred Stock) |

| | $ | | December 31, 2027 | ||

Class A Common Stock (Vendor Warrants) | | $ | | ||||

Class A Common Stock (Underwriter Warrants) | | $ | | November 21, 2029 | |||

Common Stock Reserved for Future Issuance

Shares of common stock reserved for future issuance relate to outstanding preferred stock, warrants and stock options as follows:

| March 31, | |

2025 | ||

Stock options to purchase common stock |

| |

Warrants outstanding for future issuance of common stock |

| |

Stock options available for future issuance |

| |

Total shares of Class A Common Stock reserved |

| |

At-the-Market Offering Program

In February 2023, the Company commenced an ATM offering program with H.C. Wainwright & Co., LLC (“Wainwright”), as sales agent, in connection with which the Company filed a prospectus supplement filed on February 9, 2023 (the “February Prospectus Supplement”), allowing the Company to offer and sell from time to time up to $

21

$

NOTE 6: Stock-Based Compensation

Equity Incentive Plans

In April 2014, the Board of Directors adopted the 2014 Equity Incentive Plan (the “2014 Plan”) allowing for the issuance of up to

On June 23, 2022, following approval by the Board of Directors, the Company’s stockholders adopted the 2022 Equity Incentive Plan (the “2022 Plan”) allowing for the issuance of up to

The Board of Directors may grant stock options under the 2022 Plan at an exercise price of not less than

22

Stock option activity under all of the Company’s equity incentive plans for the three month period ended March 31, 2025 is as follows:

|

|

|

| Weighted |

| |||||||

Weighted | Average | |||||||||||

Shares | Number of | Average | Remaining | Aggregate | ||||||||

Available for | Shares | Exercise | Contractual | Intrinsic | ||||||||

Grant | Outstanding | Price | Life (Years) | Value (000’s) | ||||||||

Available and outstanding as of December 31, 2024 | | | $ | | $ | | ||||||

2022 Equity incentive plan increase | | — | — | |||||||||

Granted |

| ( |

| |

| |

|

|

|

| ||

Exercised | — | — | — | |||||||||

Forfeited |

| |

| ( |

| |

|

|

|

| ||

Available and outstanding as of March 31, 2025 | | | $ | | $ | — | ||||||

Vested and exercisable as of March 31, 2025 |

| | $ | |

| $ | — | |||||

The aggregate intrinsic value in the table above represents the total intrinsic value based on the Company’s closing stock price of $

The determination of the fair value of options granted during the three months ended March 31, 2025 is computed using the Black-Scholes option pricing model with the following weighted average assumptions:

| Three Months Ended | ||||

March 31, | |||||

2025 |

| 2024 |

| ||

Risk-free interest rate |

| | % | | % |

Expected dividend yield |

| | % | | % |

Expected volatility |

| | % | | % |

Expected term (in years) |

|

| |||

A summary of stock-based compensation expense recognized in the Company’s condensed statements of operations is as follows:

| Three Months Ended | |||||

March 31, | ||||||

2025 |

| 2024 | ||||

Cost of revenue, net | $ | | $ | | ||

Research and development |

| |

| | ||

Sales and marketing |

| |

| | ||

General and administrative |

| |

| | ||

Total | $ | | $ | | ||

As of March 31, 2025, the Company had unamortized stock-based compensation expense of $

23

NOTE 7: Commitments and contingencies

Leases

The Company leases facilities for office space under non-cancelable operating lease agreements. The Company leases space for its corporate headquarters in Mountain View, California through August 2025.

As of March 31, 2025 and December 31, 2024, the components of leases and lease costs were as follows:

| March 31, 2025 |

| December 31, 2024 | |||

Operating leases |

|

| ||||

Operating lease right-of-use assets | $ | | $ | | ||

Operating lease liabilities, current portion | $ | | $ | | ||

Operating lease liabilities, non-current portion |

| — |

| — | ||

Total operating lease liabilities | $ | | $ | | ||

Operating lease costs | $ | | $ | | ||

Operating lease costs were approximately $

As of March 31, 2025, future minimum operating lease payments were as follows:

Years ending December 31, | Amount | ||

2025 (remaining nine months) | $ | | |

Total future minimum lease payments |

| | |

Less – Interest |

| ( | |

Present value of lease liabilities | $ | | |

As of March 31, 2025, the weighted average remaining lease term is

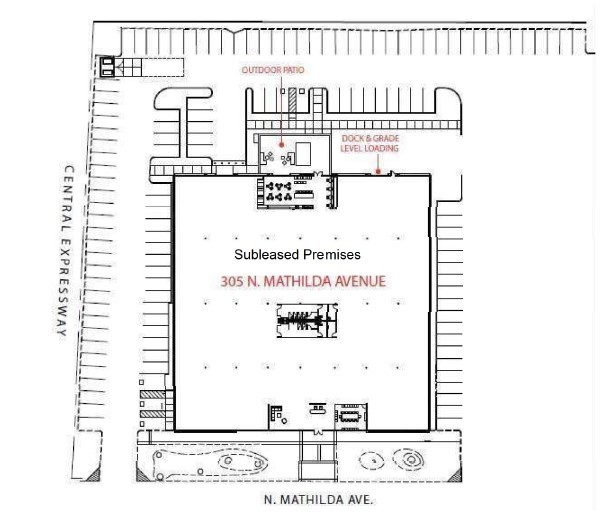

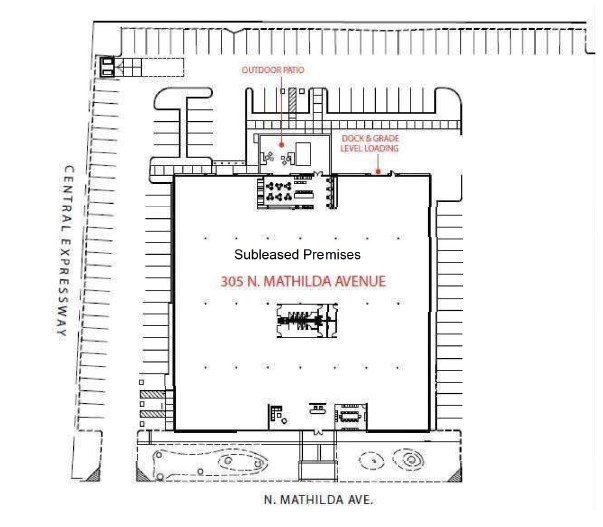

On April 9, 2025, Knightscope executed a Consent to Subletting agreement designating the associated premises as the Company’s new corporate headquarters. For additional details regarding the sublease arrangement, please refer to Note 9.

Purchase Commitments

The Company executed a purchase agreement on September 13, 2024, in order to secure the acquisition of essential to ASR production. This agreement stipulates monthly purchases of $

Legal Matters

The Company may be subject to pending legal proceedings and regulatory actions in the ordinary course of business; however, no such claims have been identified as of March 31, 2025 that would have a material adverse effect on the Company’s financial position, results of operations or cash flows.

24

The Company from time to time enters into contracts that contingently require the Company to indemnify parties against third party claims. These contracts primarily relate to: (i) arrangements with clients which generally include certain provisions for indemnifying clients against liabilities if the services infringe a third party’s intellectual property rights, (ii) the Regulation A Issuer Agreement where the Company may be required to indemnify the placement agent for any loss, damage, expense or liability incurred by the other party in any claim arising out of a material breach (or alleged breach) as a result of any potential violation of any law or regulation, or any third party claim arising out of any investment or potential investment in the offering, and (iii) agreements with the Company’s officers and directors, under which the Company may be required to indemnify such persons from certain liabilities arising out of such persons’ relationships with the Company. The Company has not incurred any material costs as a result of such obligations and has not accrued any liabilities related to such obligations in the condensed financial statements as of March 31, 2025 and December 31, 2024.

Sales Tax Contingencies

The Company has historically not collected state sales tax on the sale of its MaaS product offering but has paid sales tax and use tax on all purchases of raw materials and in conjunction with the financing arrangement of the Company’s ASRs with Farnam Street Financial. The Company’s MaaS product offering may be subject to sales tax in certain jurisdictions. If a taxing authority were to successfully assert that the Company has not properly collected sales or other transaction taxes, or if sales or other transaction tax laws or the interpretation thereof were to change, and the Company was unable to enforce the terms of their contracts with Clients that give the right to reimbursement for the assessed sales taxes, tax liabilities in amounts that could be material may be incurred. Based on the Company’s assessment, the Company has recorded a use tax liability of $

NOTE 8: Segment Information

Management identifies reportable segments based on how it manages the Company’s operations. As such, the Company operates as

The CODM assesses performance at a Company level and decides how to allocate resources based on net loss. The measure of segment assets is reported on the condensed balance sheets as total assets. The measure of significant segment expenses is listed on the condensed statements of operations. The CODM evaluates performance and allocates resources for its reportable segment using segment income or loss. This metric is used to evaluate the overall financial performance of the segment, make operational and strategic decisions, prepare the Company’s annual plan, and allocate resources.

NOTE 9: Subsequent Events

Lease

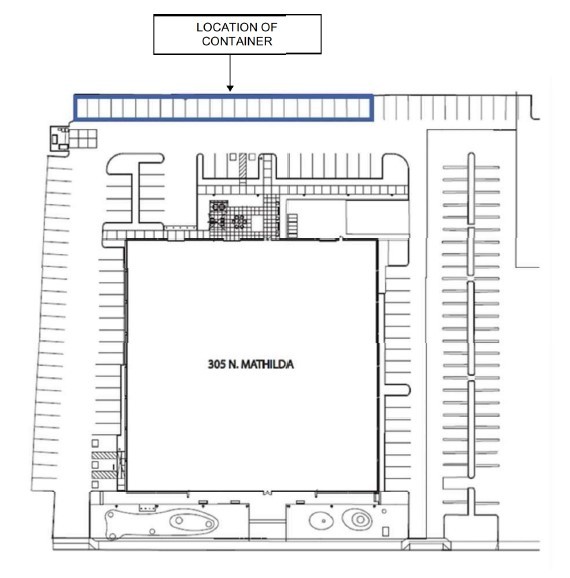

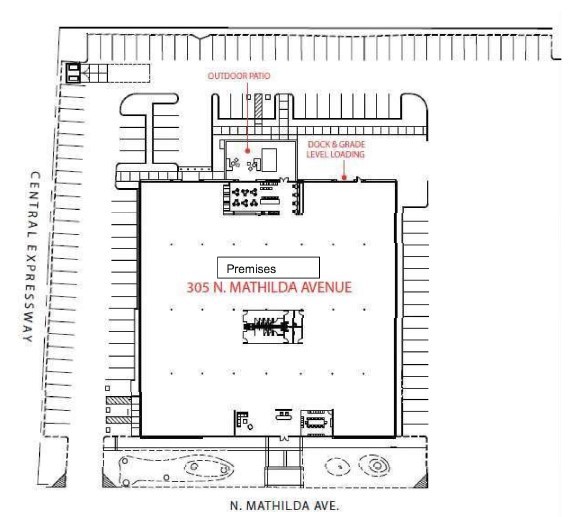

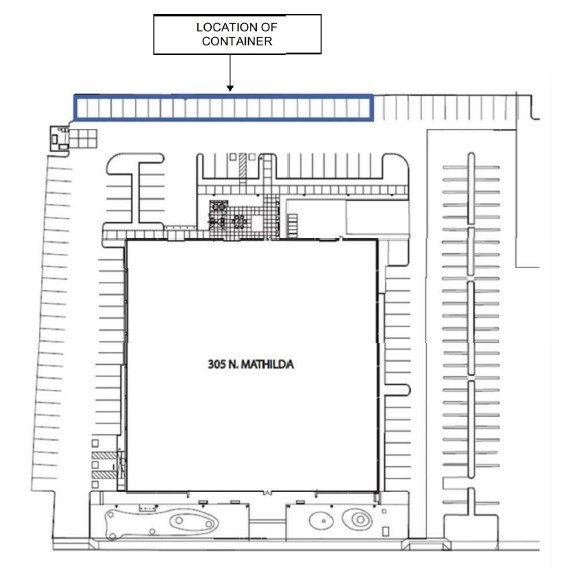

On April 9, 2025, the Company entered into a Consent to Subletting (the “Landlord Consent”) by and between 305 N Mathilda LLC (the “Landlord”), Siemens Medical Solutions USA, Inc. (the “Sublandlord”) and the Company, thereby receiving the necessary landlord consent in connection with a sublease entered into between Sublandlord and the Company, dated as of March 13, 2025 (the “Sublease”) for

25

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with the (1) unaudited condensed financial statements and the related notes thereto included elsewhere in this report, and (2) the audited financial statements and the related notes thereto and management’s discussion and analysis of financial condition and results of operations for the year ended December 31, 2024 included in our Annual Report on Form 10-K.

The historical results presented below are not necessarily indicative of the results that may be expected for any future period. Forward-looking statements about our business, results of operations, cash flows, financial condition and prospects based on current expectations that involve risks, uncertainties, and assumptions, and other important factors. Our actual results could differ materially from such forward-looking statements. Factors that could cause or contribute to those differences include, but are not limited to, those identified below and those discussed in “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K, as updated by our other filings with the SEC, and the section titled “Cautionary Note on Forward-Looking Statements” included elsewhere herein.

Overview

Knightscope is dedicated to transforming public safety through AI-driven robotics, emergency communication solutions, and real-time monitoring. Our comprehensive suite of solutions includes Autonomous Security Robots (“ASR”), advanced AI-powered detection, emergency communication devices (“ECD”), and the cloud-based Knightscope Security Operations Center (“KSOC”), providing organizations with scalable, 24/7 autonomous monitoring. Our products are manufactured in the United States and are designed to protect people and assets across various environments, including workplaces, schools, and public areas.

Our core technologies are a unique combination of autonomy, robotics, artificial intelligence and electric vehicle technology:

| ● | ASRs: AI-powered autonomous security robots that are designed to provide continuous monitoring, real-time incident detection, and proactive threat deterrence through a strong physical presence. |

| ● | ECDs: Blue light emergency communication systems, including towers, e-phones, and call boxes, designed to provide instant connectivity to emergency services. |

| ● | Knightscope Security Operations Center (KSOC): A cloud-based platform for real-time security monitoring, data analysis, and event management driven by autonomous security robots. |

| ● | Knightscope Emergency Management System (KEMS): A diagnostics tool designed to keep emergency communication devices operational and reliable. |

| ● | Knightscope Network Operations Center (KNOC): The Company has built a custom set of tools that enables our employees to manage and monitor the network of ASRs and other Knightscope technologies operating in the field nationwide. |

| ● | Knightscope's Risk & Threat Exposure (RTX): RTX analysts provide proactive monitoring by verifying alerts triggered by Knightscope devices. |

26

Recent Developments

Reverse Stock Split

On August 16, 2024, stockholders approved a reverse stock split at a ratio between 1-for-5 and 1-for-50. On September 4, 2024, the Board set the final ratio at 1-for-50 for both Class A and Class B Common Stock. The split became effective on September 13, 2024, following the filing of an amendment to the Certificate of Incorporation in Delaware. No fractional shares were issued; instead, affected stockholders received a cash payment based on the September 13 closing price on Nasdaq, totaling approximately $78. All outstanding stock options were adjusted accordingly, and all share and per-share amounts in financial statements were retroactively updated to reflect the split.

Capital Structure

The Company has prioritized restructuring its capital structure to better align with its public company peers. Below is a summary of actions taken, which we believe, set up the Company for long term success.

Increase in Authorized Shares - On April 5, 2024, stockholders approved an amendment to double the authorized shares of Class A Common Stock from 114 million to 228 million. The increase provides flexibility for corporate purposes such as financings, stock splits or dividends, equity awards, conversions, and strategic initiatives, without needing further stockholder approval.

Preferred Stock Conversion - On May 15, 2024, all outstanding Super Voting and Ordinary Preferred Stock automatically converted into Class B and Class A Common Stock, respectively, per the Company’s Certificate of Incorporation. No preferred stock remains outstanding. The conversion supports Nasdaq compliance by aiding stockholder equity requirements.

Authorization of Blank Check Preferred Stock - On August 16, 2024, stockholders approved the authorization of 40 million shares of "blank check" preferred stock, allowing the Board of Directors to issue new preferred shares in one or more series with terms it sets, without further stockholder approval. Provisions related to previously issued preferred stock were removed, as they are no longer outstanding.

Extinguishment of Warrants with Anti-Dilution Features - On October 10, 2022, the Company issued senior secured convertible notes and warrants to purchase 22,768 Class A shares under a Securities Purchase Agreement with Alto Opportunity Master Fund. The warrants included anti-dilution provisions adjusting the exercise price and share quantity if lower-priced stock was later issued. A related registration rights agreement granted the holder registration rights under the Securities Act.

On August 1, 2024, the Company and the holder entered into a waiver agreement, canceling the 2022 warrants in exchange for a $3.0 million senior secured promissory note due July 1, 2025. The note is payable in two installments: $2.5 million in 11 equal monthly payments starting September 1, 2024, and $500,000 on the earlier of October 15, 2024, or upon a qualifying issuance of equity or debt. The note bears no interest unless an event of default occurs, in which case a 10% annual interest applies. As of May 13, 2025, approximately $0.5 million remains outstanding.

Operational Efficiency

The Company is focused on scaling its business and on implementing strategies to decrease gross margin loss over time.

Although the disruptions from restructuring changes we made in the first half of the prior year continue to impact operations, we are beginning to see benefits, primarily as we work closely with our third-party partners to streamline field services for our ECD clients and renegotiate some long-term services contracts.

Additionally, we believe our efforts to improve the ASR K5 v5 are showing promise in higher install base and increased customer retention. The Company continues to invest in revenue-generating activities such channel partnerships, lead generation, marketing and programs aimed at increasing our engagement with the federal government.

27

Our strategy is to try to keep fixed costs low while minimizing variable costs in conjunction with pursuing our growth objectives; however given the global nature of our supply chain, our business is subject to the imposition of tariffs and other trade barriers, which may make it more costly for us to import raw materials and components for our products.

As of May 7, 2025, the Company had a total backlog of approximately $2.5 million, comprised of $1.9 million related to orders for ECDs and $0.6 million related to ASR orders.

Results of Operations

Comparison of the Three Months Ended March 31, 2025 and 2024

The following table sets forth selected Condensed Statements of Operations data (in thousands) and such data as a percentage of total revenue.

| Three Months Ended March 31, |

| |||||||||

2025 |

| % of Revenue |

| 2024 |

| % of Revenue |

| ||||

Revenue, net | |||||||||||

Service | $ | 2,108 | 72 | % | $ | 1,691 | 75 | % | |||

Product | 809 | 28 | % | 563 | 25 | % | |||||

Total revenue, net | 2,917 | 100 | % | 2,254 | 100 | % | |||||

Cost of revenue, net | |||||||||||

Service | 2,756 | 94 | % | 3,083 | 137 | % | |||||

Product | 829 | 28 | % | 616 | 27 | % | |||||

Total cost of revenue, net | 3,585 | 123 | % | 3,699 | 164 | % | |||||

Gross loss |

| (668) |

| (23) | % |

| (1,445) |

| (64) | % | |

Operating expenses: | |||||||||||

Research and development |

| 2,125 |

| 73 | % |

| 1,569 |

| 70 | % | |

Sales and marketing |

| 1,275 |

| 44 | % |

| 1,506 |

| 67 | % | |

General and administrative |

| 2,760 |

| 95 | % |

| 3,641 |

| 162 | % | |

Restructuring charges | — | — | % | 119 | 5 | % | |||||

Total operating expenses |

| 6,160 |

| 211 | % |

| 6,835 |

| 303 | % | |

Loss from operations |

| (6,828) |

| (234) | % |

| (8,280) |

| (367) | % | |

Other income (expense): | |||||||||||

Change in fair value of warrant and derivative liabilities |

| — |

| — | % |

| 770 |

| 34 | % | |

Interest income (expense), net | (81) | (3) | % | (65) | (3) | % | |||||

Other income (expense), net |

| 12 |

| — | % |

| (17) |

| (1) | % | |

Total other income (expense) |

| (69) |

| (2) | % |

| 688 |

| 31 | % | |

Net loss before income tax expense |

| (6,897) |

| (236) | % |

| (7,592) |

| (337) | % | |

Income tax expense |

| — |

| — | % |

| — |

| — | % | |

Net loss | $ | (6,897) |

| (236) | % | $ | (7,592) |

| (337) | % | |

Revenue, net

Total revenue, net for the three months ended March 31, 2025 increased by approximately $0.7 million compared to the same period in the prior year due to a $0.4 million increase in service revenue and $0.2 million increase in product revenue.

Cost of revenue, net

Total cost of revenue, net of $3.6 million for the three months ended March 31, 2025 decreased approximately $0.1 million compared to the same period in the prior year. This decrease was primarily due to lower cost of revenue in services of $0.3 million partially offset by higher costs of revenues in product of $0.2 million.

28

Service cost of revenue, net came in $0.3 million lower as compared to the same period in 2024 due to $0.8 million in savings from one-time scrap fees in 2024 and $0.1 million in lower cellular fees partially offset by $0.5 million in higher third-party expenses.

Product cost of revenue, net for the three months ended March 31, 2025 of $0.8 million was $0.2 million higher than prior year due to $0.3 million in increased costs of materials partially offset by $0.1 million in lower payroll and $0.1 million in lower rent and utilities costs.

Gross Loss

The revenue and cost of revenue described above resulted in a gross loss for the three months ended March 31, 2025 of approximately $0.7 million, net, compared to $1.4 million for the three months ended March 31, 2024.

Research and Development

| Three Months Ended |

|

|

|

| |||||||

March 31, |

| |||||||||||

2025 |

| 2024 | $ Change | % Change |

| |||||||

Research and development | $ | 2,125 | $ | 1,569 | $ | 556 |

| 35 | % | |||

Percentage of total revenue |

| 73 | % |

| 70 | % |

|

|

|

| ||

Research and development expenses increased by approximately $0.6 million, or approximately 35% for the three months ended March 31, 2025, as compared to the same period in the prior year. The increase is primarily due to third-party engineering services as the Company continues to invest in the development of new products.

Sales and Marketing

| Three Months Ended |

|

|

|

| |||||||

March 31, |

| |||||||||||

2025 |

| 2024 | $ Change | % Change |

| |||||||

Sales and marketing | $ | 1,275 | $ | 1,506 | $ | (231) |

| (15) | % | |||

Percentage of total revenue |

| 44 | % |

| 67 | % |

|

|

|

| ||

Sales and marketing expenses decreased by approximately $0.2 million, or approximately 15%, for the three months ended March 31, 2025, as compared to the same period in the prior year. The decrease was primarily due to a decline in advertising and promotional costs compared to the same period in the prior year.

General and Administrative

| Three Months Ended |

|

|

|

| |||||||

March 31, |

| |||||||||||

2025 |

| 2024 | $ Change | % Change |

| |||||||

General and administrative | $ | 2,760 | $ | 3,641 | $ | (881) |

| (24) | % | |||

Percentage of total revenue |

| 95 | % |

| 162 | % |

|

|

|

| ||

General and administrative expenses decreased by approximately $0.9 million or approximately 24% for the three months ended March 31, 2025, as compared to the same period in the prior year. The decrease was primarily due to $1.0 million lower investor relations fees that the Company spent in prior year to support its Public Infrastructure Bond Offering and $0.3 million lower third-party professional fees, primarily legal and finance services. These decreases were partially offset by $0.2 million higher costs across corporate insurance, franchise taxes and other items.

29

Restructuring Charges

Three Months Ended |

| |||||||||||

March 31, |

| |||||||||||

| 2025 |

| 2024 |

| $ Change |

| % Change |

| ||||

Restructuring Charges | $ | — | $ | 119 | $ | (119) |

| 100 | % | |||

Percentage of total revenue |

| — | % |

| 5 | % |

|

|

|

| ||

Restructuring charges were $0 for the three month period ended March 31, 2025 compared to $119 for the same period in the prior year.

Other Income (expense)

Three Months Ended |

| |||||||||||

March 31 |

| |||||||||||

| 2025 |

| 2024 |

| $ Change |

| % Change |

| ||||

Change in fair value of warrant and derivative liability | $ | — | $ | 770 | $ | (770) |

| (100) | % | |||

Interest income (expense), net | (81) | (65) | (16) | (25) | % | |||||||

Other income (expense), net | 12 | (17) | 29 | 171 | % | |||||||

Total other income (expense) | $ | (69) | $ | 688 | $ | (757) | (110) | % | ||||

Total other income (expense) decreased by approximately $0.8 million, or 110% for the three months ended March 31, 2025 as compared to the same period in the prior year as non-cash income from change in the fair value of warrant and derivative liabilities in 2024 was not repeated in 2025. The Company extinguished its outstanding warrant liability in 2024.

Liquidity and Capital Resources